On 19 May 2017, the Treasury Laws Amendment (Enterprise Tax Plan) Bill 2017 received Royal Assent, containing following amendments which have significant influence on entities’, especially SMEs’, tax return.

Schedule 1 – reduces the corporate tax rate:

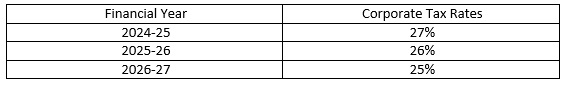

Schedule 1 reduces the corporate tax rate from 30% to 27.5% from 1 July 2016 for small business entities (SBEs). From 1 July 2017, the reduced corporate tax rate will be extended to base rate entities. From the FY25, the rate of 27.5% will progressively be cut to 25% in the following income year.

Background

Under current law, the tax rate for CTEs (corporate tax entities) is:

On 3 May 2016, as part of the 2016-17 Federal Budget, the Treasurer, Scott Morrison, announced that the company tax rate would be reduced to 25 per cent over 10 years.

New Law

- Corporate tax rate reduced to 27.5 per cent

New s.23(2)(a) of the ITR Act:

From 1 July 2016, the tax rate for SBEs is reduced from 28.5% to 27.5%.

- Increasing the turnover threshold

New s.23AA of the ITR Act:

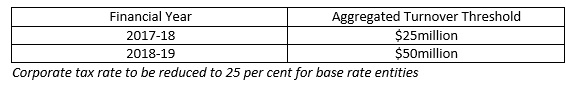

From 1 July 2017, a ‘base rate entity’ which has an aggregated turnover for the income year of less than $25 million replaces references to SBE.

New s.23AA(b) of the ITR Act:

From 1 July 2018, the definition of a term ‘base rate entity’ will be amended by increasing the aggregated turnover threshold to $50 million.

The aggregated turnover thresholds for base rate entities for the 2017-18 and 2018-19 income years are follows:

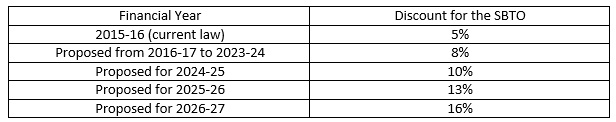

Schedule 2 – increases the rate of the small business tax offset (SBTO) progressively from 5% to 16% by the 2026-27 income year.

Schedule 2 amends the small business tax offset (SBTO) to progressively increase the offset to 16% of net small business income by the 2026-27 income year.

Background

The SBTO is a discount that is available in an income year to an individual who is an SBE or whose assessable income for the income year includes a share of the net income of an SBE that is not a corporate tax entity.

The SBTO is therefore available to individuals who are:

- SBEs;

- Partners in a partnership that is an SBE; or

- Beneficiaries of a trust that is an SBE.

The discount is currently 5% of the income tax payable on the business income received from an unincorporated SBE, capped at $1,000.

One 3 May 2016, as part of the 2016-17 Federal Budget, the Treasurer, Scott Morrison, announced that the discount for the purposes of working out the SBTO would be increased over 10 years from 5% to 16%. The current cap of $1,000 per individual for each income year will be retained.

New Law

The SBTO will be increased as follows:

Schedule 3 – amends the imputation provisions to reflect the reduction in the corporate tax rate;

Generally, the maximum franking credit that can be allocated to a frankable distribution is set by reference to the applicable tax rate. Under current rules, CTEs that are SBEs have the same franking credit cap as large CTEs.

From the 2016-17 income year, the corporate tax gross-up rate will be based on the company’s corporate tax rate for a particular income year. If the CTE did not exist in the previous income year, the entity’s corporate income tax rate for imputation purpose will be 27.5 per cent.

This means that the maximum franking credit for an SBE or BRE making a franked distribution in 2016-17 calculated under s.202-60(2) – which is:

![]() Will be based on 27.5/72.5 rather than 30/70, decreasing to 25/75 by 2026-27.

Will be based on 27.5/72.5 rather than 30/70, decreasing to 25/75 by 2026-27.

Taxation Update: TaxBanter Update Materials (20 April 2017 to 24 April May 2017), 20th ed. TaxBanter Pty Ltd, 2017, pp. 1-169.