Land tax is a hefty cost faced by many landowners, especially for foreign investors. If you own land or property in Australia, you need to understand and find out what concessions and exemptions apply to various property types and situations.

What is land tax?

Land tax is a tax levied on the owners of land, such as New South Wales (NSW) as at midnight on the 31 December of each year. Land tax applies to land regardless of whether income is earned from the land.

What is Land tax exemption? Land tax is administered by each state and territory government and is applicable everywhere in Australia except for the Northern Territory.

The laws between each border are comparable. There are many types of organisations and land purpose types that may be exempt from land tax. In particular, most states offer exemptions for land tax:

- Principal place of residence (PPOR): The principal place of residence exemption does not apply for surcharge land tax. Even if an owner is residing in the property, it will be liable for the surcharge if an owner is a foreign person.

- Primary production of land and for a retirement village;

- Boarding houses/Low cost accommodation

- Primary production land

- Non-for-profit organisations

Article from Australian Financial Review (AFR):

A 73-year-old grandfather may have to sell his retirement property nest egg after a near-1200 per cent increase in land tax in 12 months, or a rise from $5300 to more than $67,900.

Brian O’Neill’s astonishing tax bill rise is being repeated across Victoria where recent state government revaluation of land is forcing many property-owning paper millionaires to sell off their assets. O’Neill, a father of eight and grandfather of 23, bought and renovated the two-shop, seven-office complex 40 years ago. The property is located in Martin Street, Brighton, about 12 kilometres south-east of Melbourne.

Investors across Victoria are being forced to consider the sale of houses or small commercial properties that were often bought cheaply decades ago and have rapidly escalated in value during the current property boom. This could be a bellweather for property owners in other states where prices are also skyrocketing.

In response to AFR article, many industry professionals comment:

1. Significant changes will not apply to land tax assessment rate but the adjustment of free threshold and exemption is possible.

2. The AFR article focuses on the effect brought about by large scale of land revaluation activities by Victoria Office of State Revenue which contributes to higher land value leading to increase in land tax payable by owners.

3. Disputes exist in land tax calculation method in terms of the reported 12 times growth per annum. The AFR article may only serve the purpose of giving investors reminder of regular review of investment strategy. In times of property boom, the rise in land tax payable may be much quicker than rent growth.

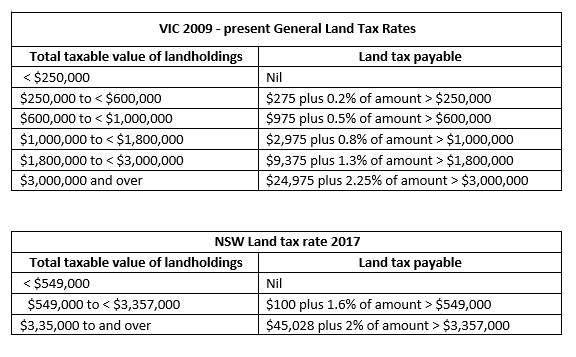

The tables show below is the land tax rate for both NSW and VIC:

Investors in other states also need to be aware of tax changes, such as reinstatement of stamp duties and changes to self-managed superannuation fund (SMSF) rules, which will impact returns.

Investors in other states also need to be aware of tax changes, such as reinstatement of stamp duties and changes to self-managed superannuation fund (SMSF) rules, which will impact returns.

Land tax on properties in Melbourne’s central business district is increasing by up to 400 per cent, or more than 26 times the state average increase of 15.8 per cent for commercial valuations in 2016.

But smaller private investors in commercial properties who cannot diversify are feeling the impact. Many investors could be forced to raise rents to cover rising costs, which might make it tougher to find tenants. Many landlords will not be able to pass on the extra cost to their tenants.

Property investors need to review the net return on their properties and decide whether it is worth retaining in its current form or has a better use (such as converting a house into apartments).

Apartments and units have higher annual rent return but lower capital growth; house has lower annual rent return due to high maintenance cost but higher potential capital growth. Townhouses stay in between and can generate higher rental income than house. It is important to understand various types of the properties before making wise decision.

“Investor crisis as “disastrous” land tax soars 1200 per cent in 12 months”, Financial Review, 2017. [Online]. Available: http://www.afr.com/personal-finance/disastrous-land-tax-soars-1200-per-cent-in-12-months-20170607-gwm9pp. [Accessed: 22- Jun- 2017].

“Land tax surcharge | Office of State Revenue”, Osr.nsw.gov.au, 2017. [Online]. Available: http://www.osr.nsw.gov.au/taxes/land-tax-surcharge. [Accessed: 22- Jun- 2017].

“Land tax current rates | State Revenue Office”, State Revenue Office, 2017. [Online]. Available: http://www.sro.vic.gov.au/ltxcurrentrates#general. [Accessed: 22- Jun- 2017].