In August 2017, there were 10,227 owner occupier first home buyer finance commitments. The 10,227 commitments was the greatest number since December 2009 and it represented 17.2% of all owner occupier housing finance commitments, its highest proportion since July 2013.

A big driver of the surge in first home buyer housing finance commitments has been some recent policy changes for first home buyers in the two largest states (NSW and Vic). From July 1 of this year first home buyers purchasing properties below $650,000 in NSW and below $600,000 in Vic do not have to pay stamp duty. In NSW stamp duty concessions are available up to a purchase price of $800,000 for first home buyers and in Vic concessions are available up to a purchase price of $750,000.

Between June and August, the number of owner occupier first home buyer housing finance commitments has increased by 59% in NSW and 34% in Vic. This data highlights that stamp duty is one of the key barriers for first home buyers wanting to participate in the housing market, at least in NSW and Vic.

Outside of NSW and Vic, first home buyers are generally larger proportions of the owner occupier segment, suggesting easier housing affordability outside of Sydney and Melbourne have held first home buyer demand comparatively high.

The following sections look at first home buyer activity across the states and territories.

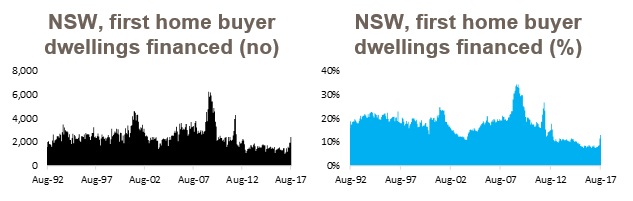

NSW

There were 2,426 first home buyer commitments in August which was the greatest monthly number since January 2012. First home buyers accounted for 12.9% of owner occupier commitments over the month which was the highest proportion since October 2012 and up from a recent low of 7.5% in February 2017.

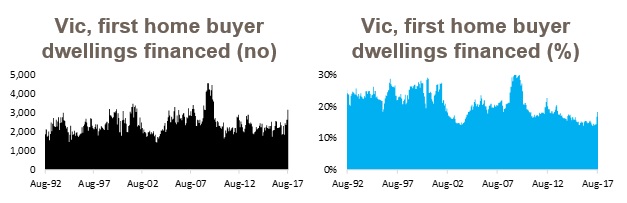

VIC

VIC

In August 2017, there were 3,162 first home buyer first home buyer commitments in Vic accounting for 18.3% of all owner occupier commitments. The 3,162 commitments was the greatest number since December 2009 and the 18.3% was the highest proportion since August 2013.

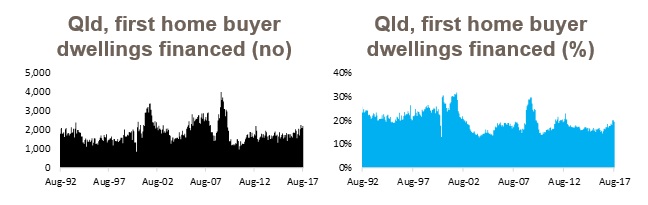

QLD

QLD

The number of first home buyer finance commitments in August 2017 (2,190) was higher than the previous month but lower than the number in June. The number of commitments in August was 17.9% higher than its long-term average. Over the month, first home buyers accounted for 19.4% of all owner occupier finance commitments, down from 20.1% in July.

ACT

ACT

There were 231 first home buyer finance commitments in August which was 47.7% higher than the long-term average. First home buyers in the ACT accounted for 19.3% of all owner occupier housing finance commitments which was slightly lower of the month.

Overall, first home buyer is expected to continue to increase, driven by NSW and Vic where buyers are taking advantage of the concessions to enter into the market.

“First Home Buyers Bounce Back on Stamp Duty Concessions in Vic and NSW”, Corelogic.com.au, 2017. [Online]. Available: https://www.corelogic.com.au/news/first-home-buyers-bounce-back-stamp-duty-concessions-vic-and-nsw?utm_source=Newsletter&utm_medium=Email&utm_campaign=PP23OCT17#.We50yOnlr-e. [Accessed: 25- Oct- 2017].