[vc_row][vc_column][vc_column_text]

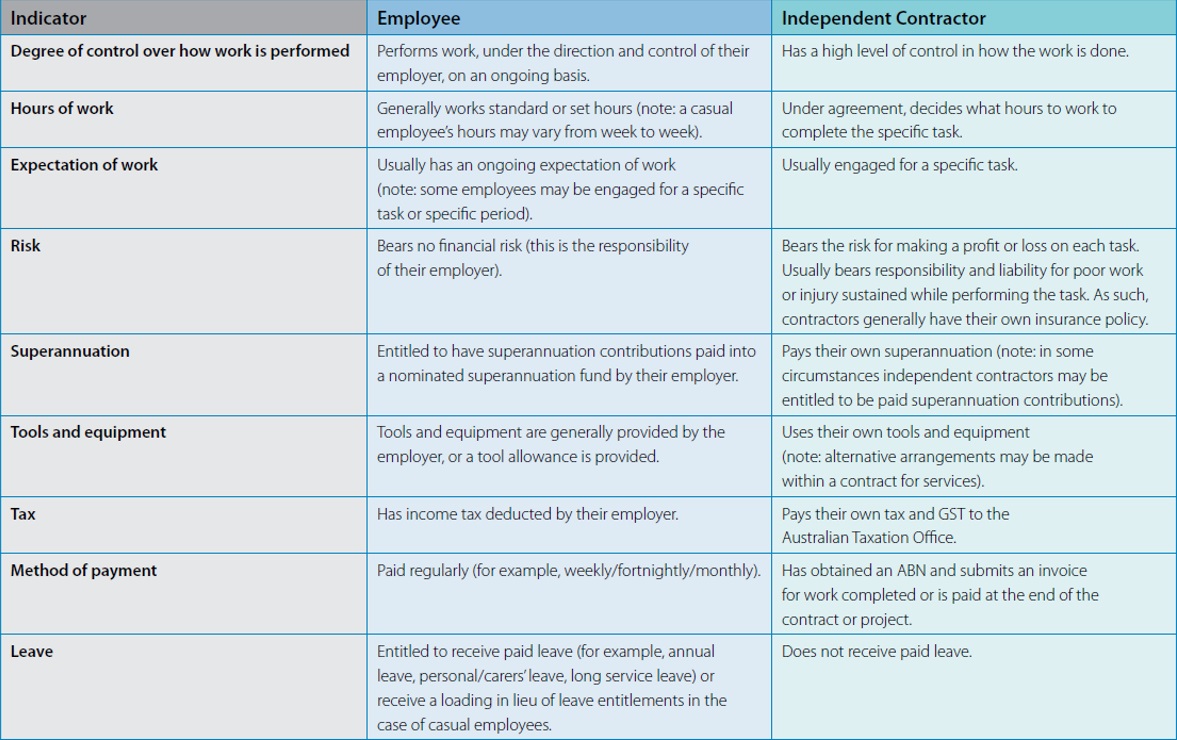

Do you have control over the way a task is performed and do you work standard hours? Do you submit tax invoices for payment and do you file GST returns? In a time when ‘sham contracting arrangements’ are on the rise, the answers to the questions above are a crucial indicator as to whether you are an employee or an independent contractor.

As a contractor, there are also a different set of tax obligations you will have to follow. You will require an Australian business number (ABN) to avoid having tax deducted at the top marginal rate of 46.5% (including 1.5% Medicare levy) and may also need to register for goods and services tax (GST). You have to register for GST if your GST turnover is at, or above the GST turnover threshold of $75,000 (exclusive of GST) and $150,000 (exclusive of GST) or more for non-profit organisations. Also, contractors have to take care of their own tax liabilities unlike their employee peers whose taxes are withheld under the PAYG withholding system.

Risks to employers of incorrectly classifying employee as a contractor are as follows:

- Failure to deduct PAYG withholding;

- Failure to pay superannuation guarantee charge (for not providing superannuation contributions);

- Failure to pay fringe benefits tax (Benefits provided to independent contractors do not fall within FBT regime);

- State liabilities and industrial liabilities such as payroll tax, worker’s compensation, award entitlements, annual leave and long service leave.

What is the difference between the two?

The definition of ‘employee’ for most tax purposes is based on common law concepts.

- ‘Employee’ is an individual employed under a ‘contract of service’ where employee contracts to provide his or her labour;

- Contractor’ is an individual who performs work for a fee under a ‘contract for services’ where independent contractor contracts to provide a result.

There are a number of factors which may contribute to determining the difference between an employee and an independent contractor. However, it is important to note that no single indicator can determine if a person is a contractor or an employee. For example, merely holding an ABN does not necessarily preclude employee status.

Each determination is based on the individual merits of the work arrangement in place. Courts always look at the totality of the relationship between the parties when determining the status of a person’s employment.

There are some common indicators that may contribute to determining whether a person is an employee or independent contractor:

Tax & Super Australia. (2017). [online] Taxpayer.com.au. Available at: http://www.taxpayer.com.au [Accessed 19 Feb. 2017].

[/vc_column_text][/vc_column][/vc_row]