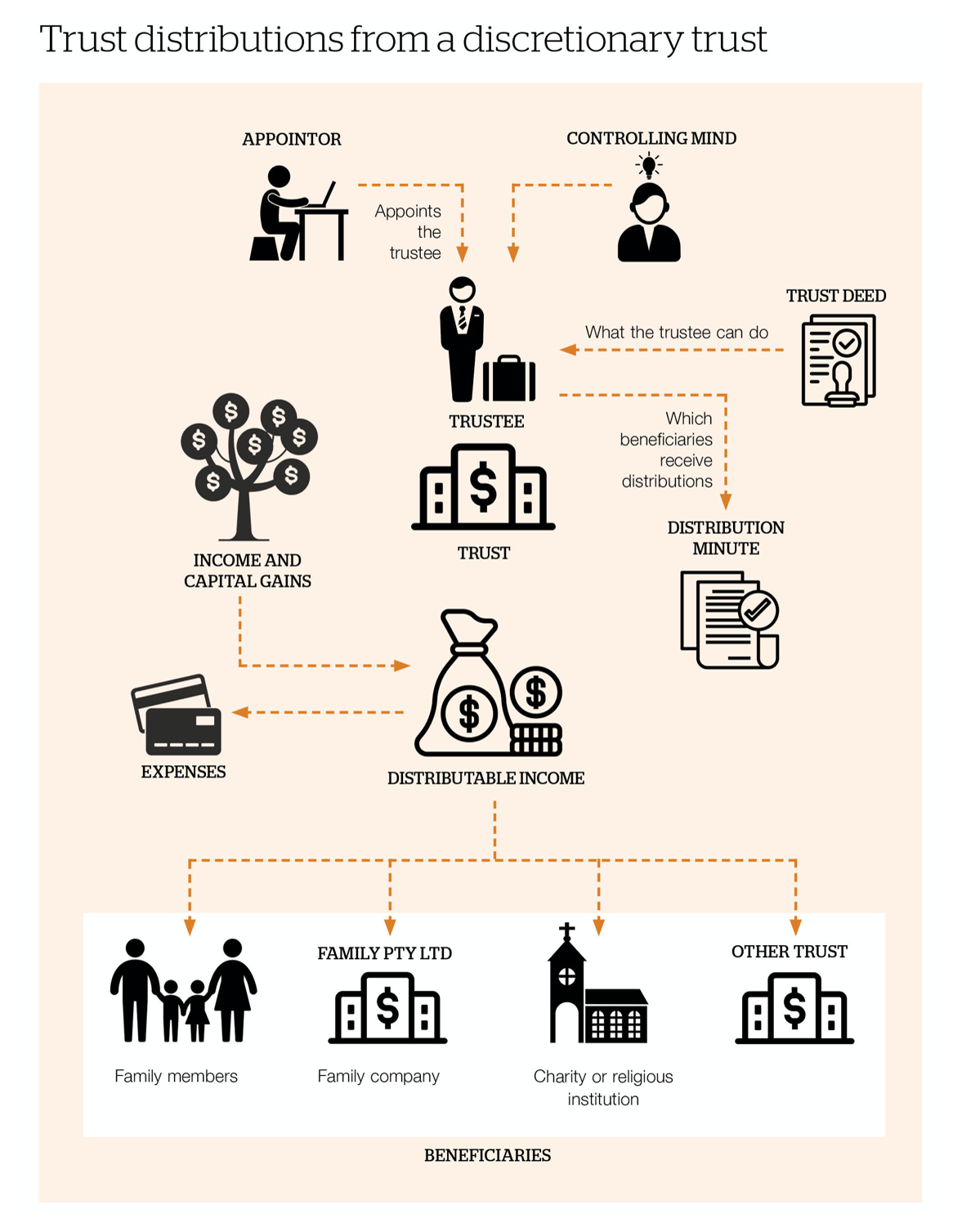

Trust distributions from a discretionary trust

The purpose of a trust is to separate the legal and beneficial ownership of assets. The legal ownership of the asset rests with the trustee. The beneficiaries benefit from the income that flows from the assets.

A trust is not a legal entity. It is best described as a legal “relationship” that is controlled by the trustee of the trust under the terms of the trust deed.

Trustee

The trustee is the controlling mind of the trust. A trustee can be an individual or a number of individuals. A trustee can also be an entity, such as a company. The trustee has a fiduciary duty to administer the trust for the benefit of the beneficiaries. A fiduciary relationship is one of the utmost good faith. The trustee must only act in accordance with the trust deed and relevant trust legislation. The trustee is the legal owner of the assets of the trust, but not the beneficial owner.

A trust is a discretionary trust when the trustee has the absolute discretion as to how the income and capital of the trust is distributed to beneficiaries.

Trust deed

The trust deed is a legal document signed by the creator of the trust, called the settlor. It gives instructions to the trustee as to how the trust is to be administered and what activities it can engage in. It also names and specifies the beneficiaries of the trust. The trust deed is a very important document.

Appointor

The appointor(s) are the individuals that appoint the trustee and can change the trustee. It is important that a trust always has a living appointor.

Distribution minute

In most cases, by 30 June each year, the trustee must determine the distributable income of the trust. The trustee must then decide how the distributable income of the trust is to be distributed among the beneficiaries. This includes the amount of the distributions and also the type of distributions (e.g. capital gains and franked distributions).

Beneficiaries

The beneficiaries are those that may benefit from the income and capital of the trust. Usually, there are primary beneficiaries defined in the trust deed and most other beneficiaries will be related or connected to the primary beneficiaries. Beneficiaries can be entities and do not have to be human beings.

Taxation

Income distributed to adult beneficiaries and beneficiaries that are entities are taxed to those beneficiaries. The trustee is taxed on income distributed to child beneficiaries. The trustee is also taxed, often at the top marginal tax rate, if there is income of the trust that has not been distributed to a beneficiary.

Note that the taxation of trust income can be a complex matter, and usually requires professional advice.

Trust losses: Keeping them in the family

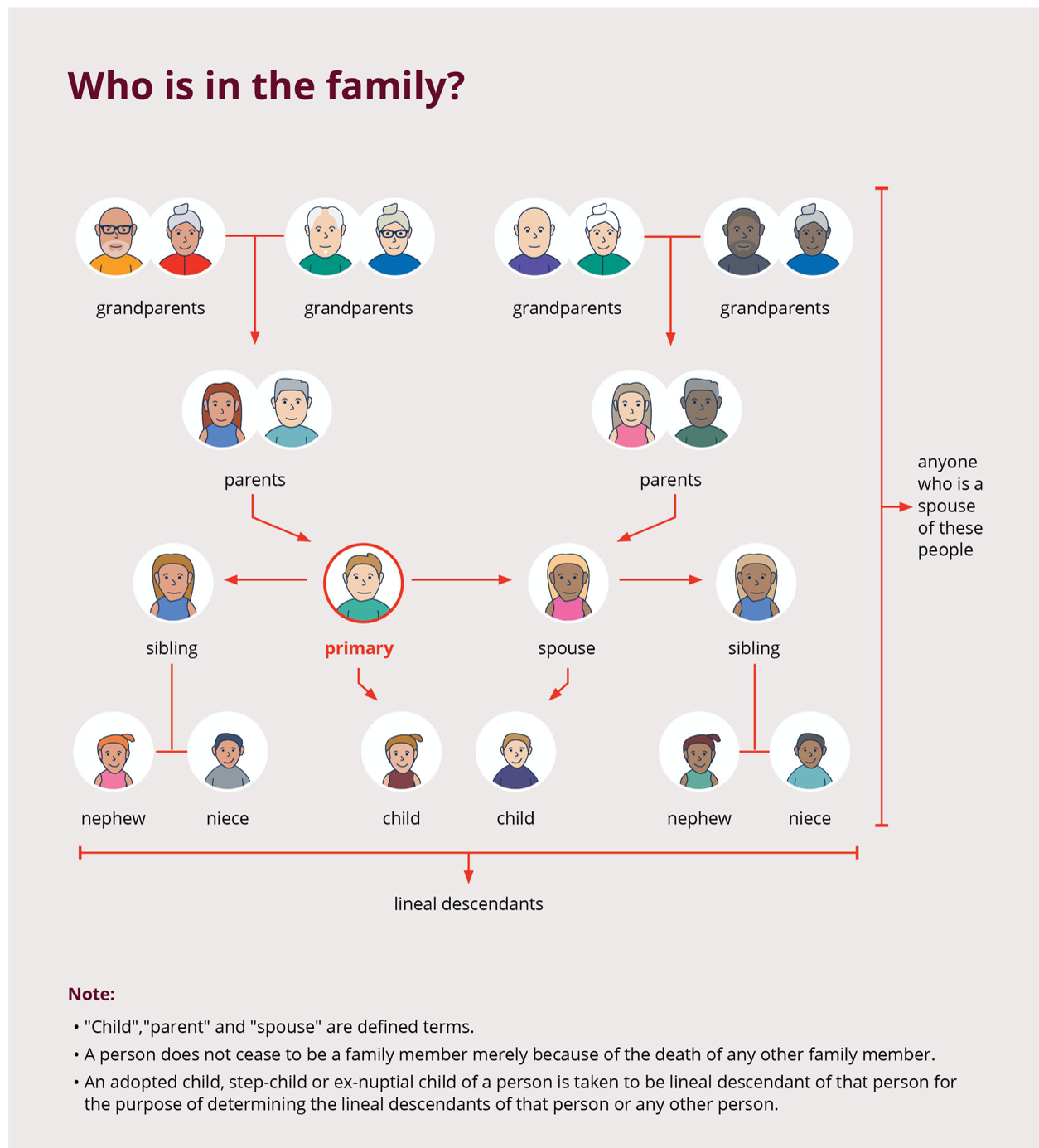

Who can (and can’t) be part a family group for the purpose of making a family trust election (FTE)?

As you can see by the diagram below/at left/right, the ‘family group’ is dependent on the choice of the ‘test individual’. Once that person is chosen, the family group includes the person’s spouse, plus any of their children, grandchildren, parents, grand- parents, brothers, sisters, nephews, or nieces. The spouses of any of these people are also included.

The family group can include a de facto spouse, stepchildren and half-brothers and half-sisters, but not aunts and uncles, cousins, great-grandchildren, or stepbrothers and stepsisters. The spouse of a deceased test individual will continue as a member, but not if they partner up again. And where a married test individual is divorced, the family group membership of their former spouse is ended. However, the former spouse is still in the family group in relation to distributions.

Importantly, if the test individual dies, the trust remains a family trust and the family group continues to be worked out by reference to the test individual.

Where an FTE is made, the rules that limit the deductibility of prior year and current year losses and bad debt deductions are much less onerous. Only the income injection rule applies, and then only where a person outside the family group is involved. Otherwise, there is also a 50% stake test, a control test and a pattern of distribution test that have to be satisfied.

Having an FTE also relaxes the company loss tracing rules, the holding period governing access to franking credits and the application of the trust beneficiary reporting rules.

Keep the diagram handy when confirm who the beneficiaries of a family trust can be, without paying family trust distributions tax.

Disclaimer:

The material and opinions in this article are those of the author and not those of AP Family Office. The material and opinions in the article should not be used or treated as professional advice and readers should rely on their own enquiries in making